Irs Quarterly Payment Schedule 2024 – Americans who fail to make on-time and accurate estimated quarterly tax payments could be hit with a surprise bill after the IRS penalty jumped to 8%. . If you’re required to pay quarterly estimated taxes have started filing their taxes for the 2023 tax year on Jan. 29.. You can use the schedule chart below to estimate when you can expect .

Irs Quarterly Payment Schedule 2024

Source : thecollegeinvestor.com2024 Tax Deadlines for the Self Employed

Source : found.comTax Due Dates For 2024 (Including Estimated Taxes)

Source : thecollegeinvestor.comBracing for Tax Season? How to Handle Estimated Taxes in 2024

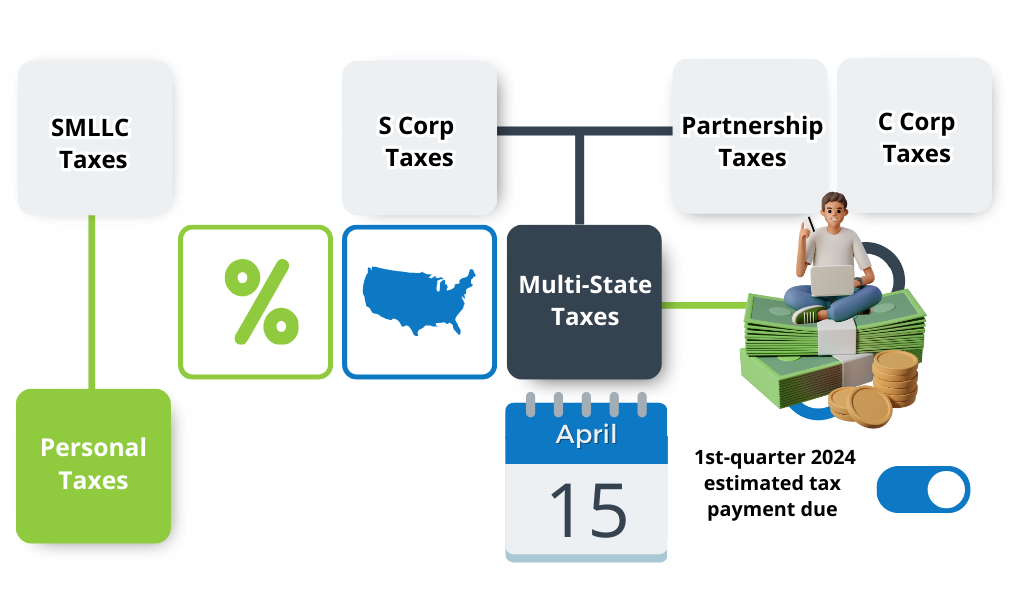

Source : rcmycpa.comBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.comTax Tip: Estimated Tax Payments TAS

Source : www.taxpayeradvocate.irs.govTraders Should Focus On Q4 Estimated Taxes Due January 16 | Green

Source : greentradertax.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govIRS e file Refund Cycle Charts

Source : igotmyrefund.comTax Filing Deadline Dates 2024

Source : www.fusiontaxes.comIrs Quarterly Payment Schedule 2024 When To Expect My Tax Refund? IRS Refund Calendar 2024: This includes many workers who have picked up a side gig in recent years and may not know they are susceptible to it. Find Out: The 7 Worst Things You Can Do If You Owe the IRSRead More: Owe Money to . Time flies, and before you know it, Tax Day will be here. Don’t forget — this is the last day to pay taxes for 2023. .

]]>