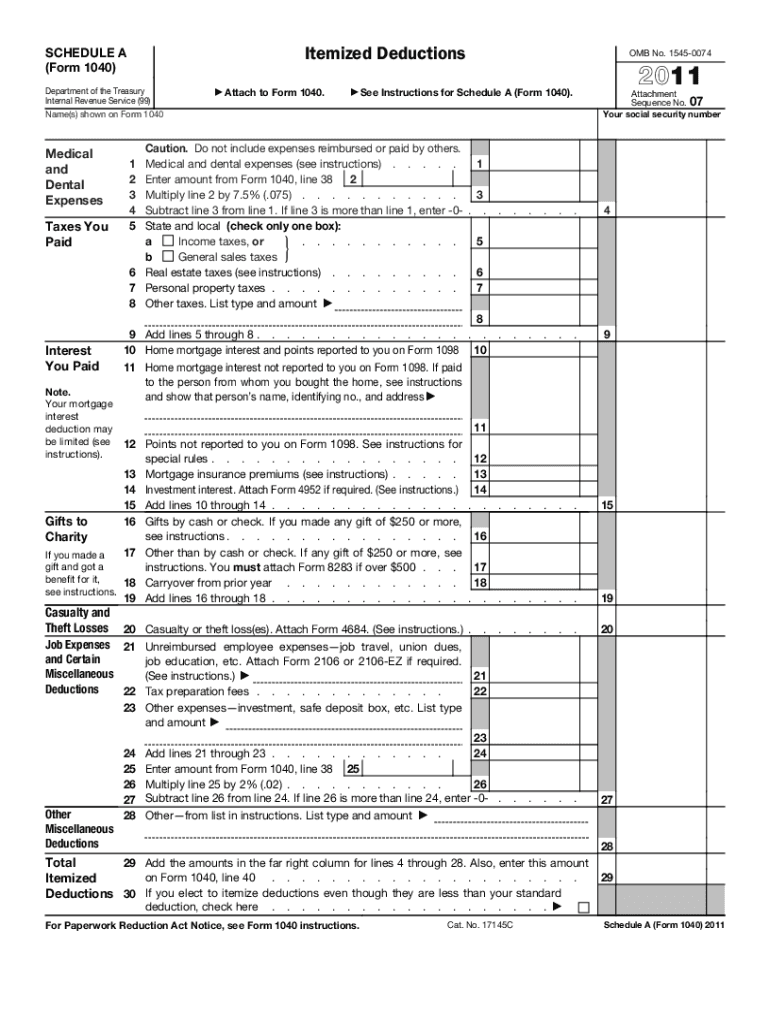

Itemized Deductions Form 2024 – For roughly 1 in 10 taxpayers, itemizing deductions — rather than claiming the standard deduction — is the better game plan. Here’s why. . Self-employed workers can claim their mileage deduction on their Schedule C form, rather than the Schedule A form for itemized deductions. Mileage for self-employed workers isn’t subject to any .

Itemized Deductions Form 2024

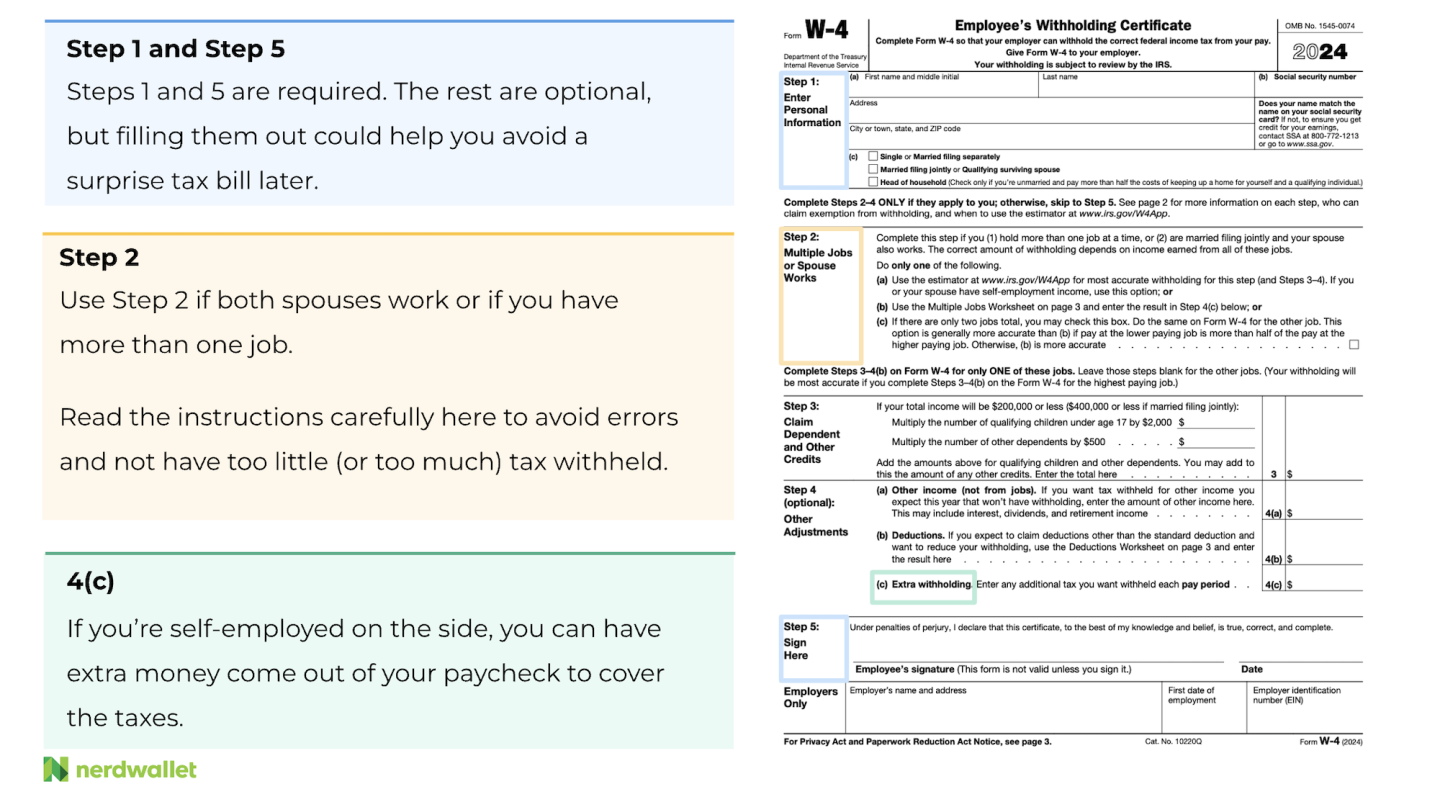

Source : www.investopedia.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comEmployee’s Withholding Certificate

Source : www.irs.govHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.com2024 Form W 4P

Source : www.irs.govPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govList of itemized deductions worksheet: Fill out & sign online | DocHub

Source : www.dochub.comIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.comItemized Deductions Form 2024 All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: Here are a few terms every taxpayer should understand in order to make the most of their money. Don’t Miss: Join millions of people getting paid for sharing their opinions. Earn up to $40 per month . To claim your itemized deductions, fill out Schedule A of the Form 1040. Each line on the schedule describes a specific type of allowable expense that can be itemized. How to calculate itemized .

]]>:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)